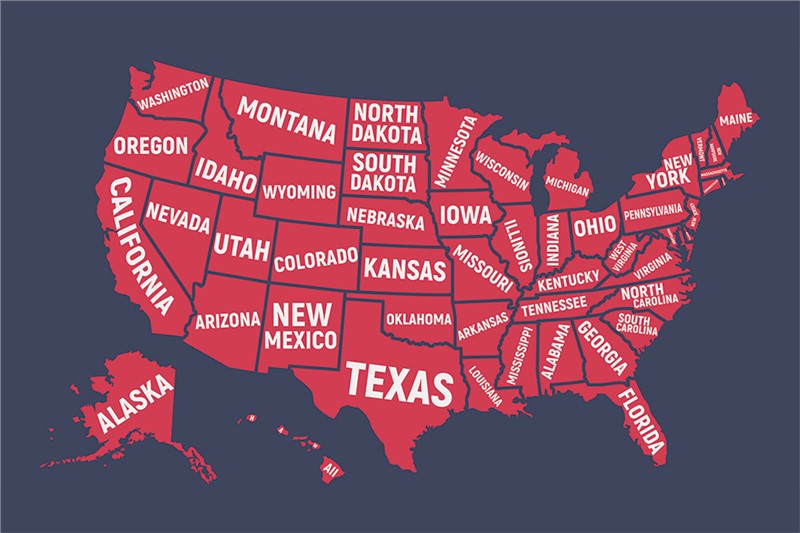

With all states in the U.S having different tax laws, moving to a new location if your business is location-independent can skyrocket your growth. However, your tax burden shouldn't be the only thing you consider when relocating.

It would help if you also focused on the area's recreation and weather. Picking a location that is appealing to employees helps to retain talent and attract better employees. Three states that are excellent choices to relocate, according to professional Atlanta commercial movers, are:

- Florida

- Nevada

- North Carolina

Moving Your Business To Lower Your Income Taxes

Two of the biggest taxes that companies face are corporate income and personal income taxes. If you are looking to decrease your business's tax burden, moving to a state with low income taxes should be your top priority. As our top three choices for business relocation, according to TaxFoundation, the states we picked have a rating of corporate income tax at:

- North Carolina: Ranked 4th, North Carolina has the lowest state corporate tax rate of the three with a tax of 2.50%.

- Florida: Ranked 6th, Florida has one of the lowest corporate income tax rates. The current corporate income tax rate is 5.5%.

- Nevada: Ranked 25th, Nevada does not have a state corporate income tax. But, you will still need to file federal business income taxes.

Corporate income tax is only one piece of the puzzle for filing your taxes as a business. Personal income tax for your employees is also a significant tax burden, with some states like California having the highest tax rates in the country. The three states recommended by our Atlanta office movers have a personal income tax ranking of:

- Florida: Ranked 1st, Florida does not have a personal income tax.

- Nevada: Ranked 5th, Nevada does not have a state personal income tax.

- North Carolina: Ranked 16th, North Carolina has a state personal income tax of 5.25%

Moving Your Business To Attract and Keep Employees

Along with lowering your tax burden, you should also think about relocating to a place that will benefit your employees. All three of the options we shared have great weather, outdoor recreation, and popular cities for working professionals. With sunny weather for most of the year, Florida and Nevada are great for keeping spirits high.

Talented professionals also flock to these states more often for more career opportunities and recreational activities. North Carolina is also a major center for career opportunities, with several large metropolitan areas. These large cities don't take away from the feeling of community from this state, and it is also a great place to raise a family for employees.

ALS Van Lines Business and Employee Relocation Services

For all things business moving, you can trust ALS Van Lines to help you every step of the way. We make the process as seamless as possible, from packing supplies to setting up warehouse storage for your furniture. Our Atlanta business movers are highly skilled and will ensure that all of our company’s belongings stay safe and secure.

A business is nothing without its hard-working employees. We also offer employee relocation services to help them get set up in their new state. Our team will coordinate with your HR department to plan the move on a large scale. We will pack their furniture, supplies, and personal belongings and move them to their new home.

Learn More About Our Atlanta Business Moving Services

If you are ready to lower your business’s tax burden, live in beautiful weather, and attract the best talent in the country, we are here to help. Our team will assist you through the business relocation process and make it as hassle-free as possible. Contact us today for a free consultation and moving estimate.

Subscribe to ALS Van Lines's Blog

Comments